BTC Price Prediction: Analyzing Technical Signals and Market Catalysts for 2025

#BTC

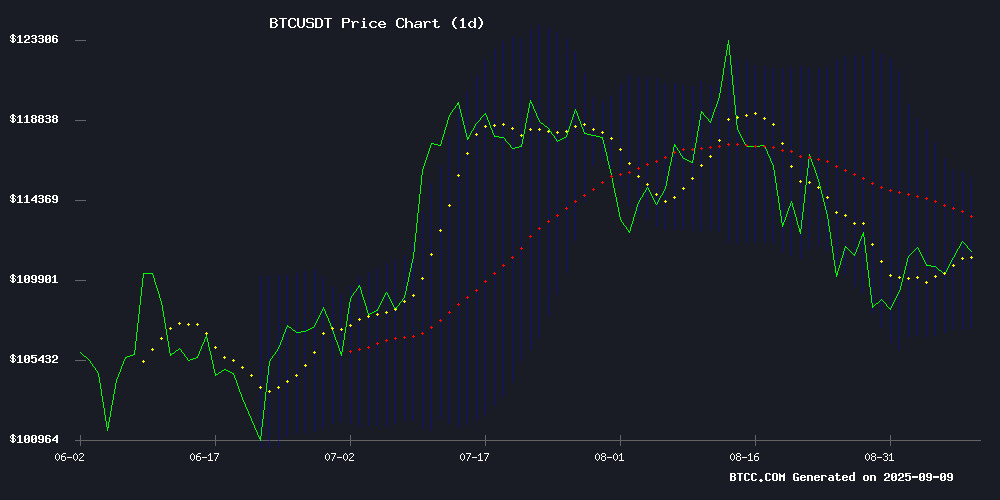

- Technical indicators show BTC trading below the 20-day moving average with bearish MACD momentum, suggesting near-term consolidation pressure

- Regulatory developments and Federal Reserve policy decisions are creating mixed market sentiment, balancing between oversight concerns and institutional adoption progress

- Price action between $107,000 support and $115,600 resistance will be critical for determining next major directional move

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Key Moving Average

BTC is currently trading at $110,962, slightly below the 20-day moving average of $111,372, indicating potential resistance at this level. The MACD reading of -873 suggests weakening momentum, though the price remains within the Bollinger Bands range of $107,143 to $115,601. According to BTCC financial analyst Emma, 'The current technical setup shows BTC consolidating NEAR important technical levels. A sustained break above the 20-day MA could signal renewed bullish momentum, while failure to hold above $107,000 could indicate further downside pressure.'

Market Sentiment: Regulatory Developments and Institutional Adoption Drive Mixed Outlook

Recent news flow presents a complex picture for Bitcoin. Regulatory developments like the CLARITY Act introduce uncertainty, while institutional adoption through products like easyGroup's Bitcoin app provides supportive fundamentals. BTCC financial analyst Emma notes, 'The market is balancing regulatory headwinds against growing institutional interest. The Fed's upcoming meeting and potential rate cuts could serve as significant catalysts, with some analysts projecting targets as high as $200,000 under favorable monetary conditions.'

Factors Influencing BTC's Price

Senate Democrats Introduce CLARITY Act to Strengthen Crypto Oversight

Senate Democrats have unveiled the CLARITY Act framework, aiming to establish clear regulatory guidelines for digital assets in the U.S. The proposal grants the Commodity Futures Trading Commission (CFTC) authority over digital commodities like Bitcoin, while the SEC will provide guidance on securities law application. Stricter disclosure requirements and heightened platform oversight mark a pivotal shift in crypto regulation.

The move comes as the digital asset market approaches a $4 trillion valuation, addressing long-standing gaps in spot market supervision. Issuers now face rigorous transparency mandates covering governance, insider holdings, and technological risks—a structural change signaling Washington's growing engagement with crypto markets.

U.S. Labor Data Revision Sparks Market Reactions, Crypto Shows Limited Response

The U.S. labor market underwent its largest benchmark revision on record, with payroll gains marked down by 911,000 jobs for the period ending March 2025. This adjustment reveals a significantly weaker labor market than previously indicated by Nonfarm Payrolls reports, which heavily influence Federal Reserve policy and capital allocation decisions.

Had the revised data been available earlier, the Fed likely would have cut rates throughout 2025. With the central bank expected to initiate rate cuts next week, this development raises the possibility of a 50 basis point reduction instead of the anticipated 25.

Rate-sensitive assets displayed muted reactions. Gold futures briefly surged to record highs before paring gains, while Bitcoin retreated from $113,000 to $111,600, down 1% on the day. The market's tepid response underscores the 'buy the rumor, sell the news' dynamic in play.

easyGroup Launches Bitcoin App for U.S. Retail Investors

easyGroup, the conglomerate behind brands like easyJet and easyHotel, is making a strategic foray into cryptocurrency with the launch of easyBitcoin.app. The mobile platform, developed in partnership with Uphold, aims to simplify Bitcoin acquisition and custody for retail investors. This rollout coincides with Bitcoin's sustained rally near all-time highs, currently trading around $112,650.

Consumer research reveals growing mainstream confidence in Bitcoin's value proposition. A Uphold-commissioned study of 1,001 affluent, educated Americans found 88% trust Bitcoin for wealth accumulation over the next decade. Notably, 39% ranked it among their top three investment choices—surpassing gold and trailing only real estate. Yet nearly half of respondents cited complexity as a persistent barrier to entry.

The easyBitcoin platform addresses these pain points through streamlined onboarding and financial incentives: 1% bonuses on recurring purchases, 2% annual rewards for long-term holders, and 4.5% APY on USD balances converted to Bitcoin. FDIC insurance backing of $2.5 million provides additional security for fiat holdings.

"We're democratizing access to what's been perceived as an exclusive asset class," said easyGroup founder Stelios Haji-Ioannou, highlighting the platform's mission to reduce transactional friction. Expansion plans include a forthcoming U.K. version of the application.

Eric Trump Predicts Crypto Boom in 12–18 Months, Highlights South Korea's Leadership

Eric Trump, speaking virtually at the Upbit D Conference in Seoul, forecasted explosive growth for cryptocurrency markets within the next 12 to 18 months. He emphasized Asia's readiness for this surge, with South Korea at the forefront of adoption and innovation. "Korea is doing it the best out of any country in Asia," he declared, warning other nations against falling behind.

The Trump Organization plans to expand into South Korea's digital asset and real estate markets, signaling a strategic push into the region. This move coincides with a 30% surge in the Trump family's DeFi project, WLFI, following its public debut, though it later pulled back slightly. Meanwhile, American Bitcoin, the family's mining venture, has boosted Eric Trump's stake to over $500 million.

His remarks underscore the Trump family's deepening involvement in crypto ventures and their advocacy for pro-crypto policies in the U.S. The market reaction to these developments highlights the growing influence of institutional players in shaping crypto's future.

Bitcoin Rebounds Past $112K as GMO Miner Offers Stable Yield Play

Bitcoin staged a decisive recovery above $112,000 after testing support at $108,000 last week, demonstrating resilience despite lingering market caution. Derivatives metrics reveal a bifurcated landscape: The 9% delta skew in BTC options reflects persistent demand for downside protection, while rebounding perpetual funding rates at 11% signal improving sentiment among leveraged traders.

Against this backdrop, GMO Miner positions its cloud mining service as a volatility hedge. The platform eliminates hardware acquisition and energy costs, offering standardized computing power packages. Daily yields are advertised at $6,800, though operational details remain undisclosed. This contrasts with direct BTC exposure, where mixed options flow—evidenced by the rising put/call ratio—suggests professional traders are maintaining defensive strategies even as spot prices advance.

Bitcoin’s Volatility Set to Surge, Echoing Summer 2023 Patterns

Bitcoin (BTC) is poised for significant price swings in October, mirroring a volatility pattern observed in 2023. The cryptocurrency has been trading in a tight range between $110,000 and $120,000, dampening market excitement and driving implied volatility (IV) metrics to near two-year lows.

The Volmex BVIV index, tracking 30-day IV, has declined to 38% annualized—approaching the 36% low seen four weeks ago. This compression mirrors last summer's setup, when IV collapsed from 50% to 35% before Bitcoin's rally from $25,000 to $46,000 ahead of spot ETF approvals.

Implied volatility reflects option markets' expectations of future price turbulence. Current ATM IV trends suggest traders anticipate a mean-reversion spike, historically preceding major Bitcoin price movements. The market appears to be coiling for a breakout.

U.S. Lawmakers Push for Treasury Report on Government-Held Bitcoin

Congress has introduced a bill mandating the U.S. Treasury to assess the Strategic Bitcoin Reserve and federal digital asset holdings. The legislation, spearheaded by Representative David P. Joyce, requires a comprehensive report within 90 days of enactment, covering legal authority, custody protocols, cybersecurity safeguards, and feasibility.

The bill underscores growing institutional recognition of Bitcoin as a strategic asset. Treasury must also outline interagency transfer mechanisms, balance sheet treatment, and third-party custodian oversight—a nod to the maturation of crypto as a treasury reserve asset.

This move follows President Trump's executive order establishing the reserve, signaling bipartisan momentum toward formalizing crypto in national financial infrastructure. The directive could set precedents for how governments worldwide manage sovereign crypto holdings.

Three Cuts, Bitcoin at $200K? What’s at Stake in the Fed’s September Meeting

Markets are bracing for a potential turning point in U.S. monetary policy as the Federal Reserve prepares for its September 16-17 meeting. Analysts anticipate up to three rate cuts this year, with a possible 50 basis point reduction next week. Such a move could catalyze a rally in risk assets, including Bitcoin, which some speculate could reach $200,000 on renewed institutional interest.

Financial institutions largely forecast a 25-basis-point cut in September, followed by additional reductions in December and early 2026. Polymarket data reveals a 17.5% probability of a more aggressive 50 bps cut, reflecting growing economic concerns. Mohamed El-Erian warns the current economic risks exceed those of 2024, recalling last year's delayed but substantial September cut.

Analysts Divided on Bitcoin's Short-Term Outlook Amid Whale Activity and Fed Rate Cut Speculation

Bitcoin's recent peak at $112,000 on September 8 has sparked contrasting analyst views. Bearish signals emerge as long-term holders liquidate positions and whale reserves drop by 100,000 BTC - mirroring 2022's bear market distribution pattern. The declining buy/sell ratio during price expansion further fuels correction fears.

Counterbalancing this, bullish proponents point to anticipated Federal Reserve rate cuts as a potential catalyst for renewed upward momentum later this month. This divergence has traders simultaneously preparing for volatility while scouting alternative opportunities.

Emerging projects like DeepSnitch AI are gaining traction, having raised $192,000 in its initial presale phase. The AI-powered analytics platform offers entry at $0.01634, attracting investors seeking exposure beyond Bitcoin's uncertainty.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents both opportunities and risks for investors. The current price of $110,962 sits near critical technical levels, with the 20-day moving average acting as immediate resistance. From a fundamental perspective, growing institutional adoption through new investment products provides long-term support, while regulatory developments and Fed policy decisions create near-term uncertainty.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $110,962 | Neutral |

| 20-day MA | $111,372 | Resistance |

| MACD | -873 | Bearish |

| Bollinger Upper | $115,601 | Upside Target |

| Bollinger Lower | $107,143 | Support Level |

BTCC financial analyst Emma suggests that investors should consider their risk tolerance and investment horizon, noting that 'while short-term volatility may persist, the long-term adoption trajectory remains positive for Bitcoin as a digital asset class.'